When it comes to selecting an insurance bond company, the stakes are high. The safety and security of your financial investment depend largely on the company you choose. With so many options available, spotting red flags that may signal a less-than-reputable organization becomes imperative. In this detailed guide, we’ll explore how to identify these potential pitfalls effectively.

Understanding Insurance Bonds

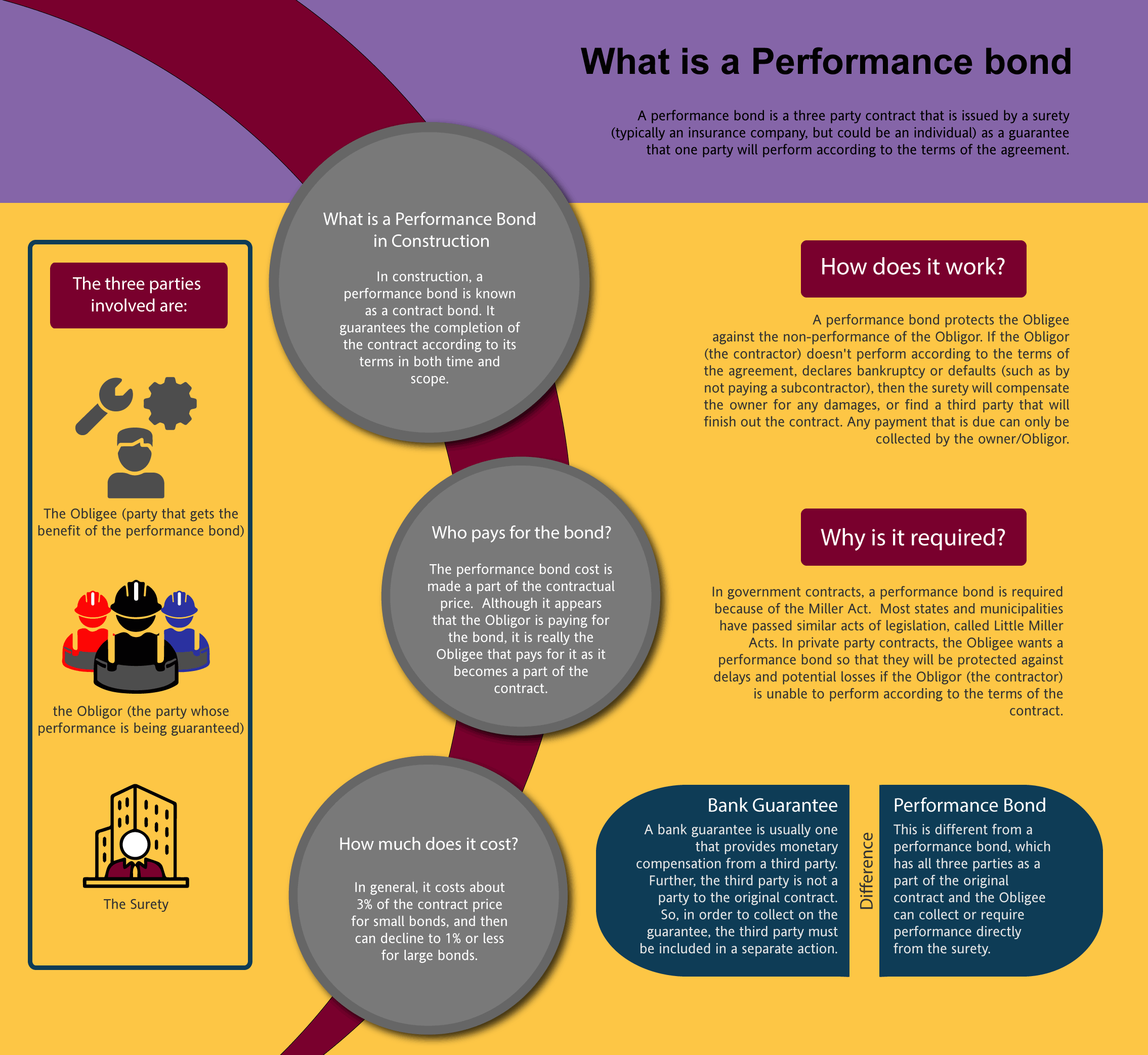

Before we dive into the nitty-gritty of spotting red flags, let’s clarify what insurance bonds are. An insurance bond is a type of financial guarantee provided by an insurance company or bonding agency. These bonds assure that certain obligations—like project completion or compliance with legal requirements—will be met.

Types of Insurance Bonds

There are several types of insurance bonds, including:

- Contract Bonds: Ensures that contractors fulfill their obligations. License and Permit Bonds: Required for various licenses and permits. Court Bonds: Used in legal proceedings.

Each type serves different purposes, but they all share the common thread of protecting against financial loss.

How to Spot Red Flags When Choosing an Insurance Bond Company

Choosing the right insurance bond company can feel overwhelming. Here are some key indicators to help you identify potential red flags:

1. Lack of Licensing and Accreditation

Before anything else, ensure the company is licensed. Every reputable insurance bond company should be registered with your state’s department of insurance.

Why Is Licensing Important?

Licensing ensures that the company adheres to industry regulations aimed at protecting consumers. If a company lacks proper licensing, it’s best to steer clear.

2. Poor Financial Ratings

Financial stability is crucial when choosing an insurance bond provider. Companies are rated by independent agencies like AM Best or Standard & Poor's.

What Should You Look For?

Check ratings; anything below “A” might raise concerns about their ability to meet claims.

3. Unclear Terms and Conditions

Comprehending the terms of service should never be a headache. If an insurance bond company uses jargon-filled language or provides unclear information, consider it a warning sign.

How Can You Avoid Confusion?

Request written documentation that clearly outlines terms and conditions, ensuring you understand all aspects before signing anything.

4. Limited Customer Feedback

Online reviews can provide insight into the experiences of previous customers. A lack of reviews—or numerous negative ones—should raise alarms.

Where Should You Look for Reviews?

Check platforms like Google Reviews, Yelp, or specialized forums where customers discuss their experiences with specific companies.

5. High Premiums Without Justification

While premiums vary between companies based on risk assessment, excessively high premiums compared how surety bonds work to competitors without adequate justification can indicate something amiss.

What Constitutes High Premiums?

Research competitors’ pricing structures and ask for detailed explanations regarding any discrepancies in quotes received from different providers.

6. Questionable Claims Handling Process

A firm’s claims handling process is critical; if it seems convoluted or takes an unreasonably long time, this could indicate inefficiency or worse—a lack of reliability.

What Questions Should You Ask?

Inquire about average claim processing times and procedures during your initial conversations with potential companies.

How to Evaluate Insurance Bond Companies Effectively

Evaluating potential candidates requires diligence and methodical research:

7. Researching Company Backgrounds

Dig deep into each prospective company's history and reputation within the industry.

What Resources Are Available?

Utilize online databases such as the Better Business Bureau (BBB) or your state’s regulatory body for background checks on companies' histories and complaint records.

8. Inquiring About Underwriting Practices

Understanding underwriting practices gives insight into how risk is assessed by various companies which directly affects premiums and approval rates for bonds issued by them.

What Should You Ask?

Questions relating to their underwriting criteria can inform you about their risk tolerance levels and overall reliability in issuing bonds.

9. Consulting Industry Professionals for Recommendations

Reach out to professionals who have experience dealing with various insurance bond companies; their insights can guide you towards reputable firms while avoiding others known for poor service practices.

Conclusion

Choosing an insurance bond company requires careful consideration and investigation into potential red flags that may indicate reliability issues down the line. By understanding the signs—including licensing status, financial ratings, customer feedback—and conducting thorough research on each option available will enable informed decisions when selecting a trustworthy provider suited for your unique needs!

FAQs

Q1: What should I do if I spot a red flag in an insurance bond company? If you notice any concerning signs while researching an insurance bond provider, it's best to look elsewhere rather than take unnecessary risks with your financial future.

Q2: How important is customer service when choosing an insurance bond company? Customer service matters significantly! A responsive team enhances communication during stressful situations like filing claims or resolving disputes over policies—so don’t overlook this aspect!

Q3: Are there any resources available for comparing different companies? Yes! Websites like NerdWallet offer comparison tools specifically designed to evaluate various types of financial services including those provided by insurers/bonding agencies!

Q4: Can I negotiate premiums with my chosen insurer? Absolutely! Many factors influence premium pricing; thus engaging in discussions about possible discounts based upon your personal circumstances might yield favorable outcomes!

Q5: Is it wise always going with larger firms instead smaller ones? Not necessarily! While larger firms may have more resources at hand—smaller niche players often deliver tailored services backed up by personalized attention which could benefit clients immensely depending on individual requirements!

**Q6: How frequently should I review my current insurer's performance? It's advisable at least annually assess coverage adequacy alongside evaluating ongoing satisfaction levels regarding interactions throughout—ensure everything remains aligned according both expectations & evolving needs!

In conclusion, navigating through options presented within today’s market demands care—but arming yourself with knowledge equips one well enough tackle challenges effectively while finding suitable partners along way!