Performance bonds play a crucial role in various industries, particularly in construction and contracting. But as with any financial tool, there are questions surrounding their safety and refundability. In this comprehensive article, we will explore the intricacies of performance bonds, dissect their refundability, and help you understand if your money is safe when you use them.

Understanding Performance Bonds

What Are Performance Bonds?

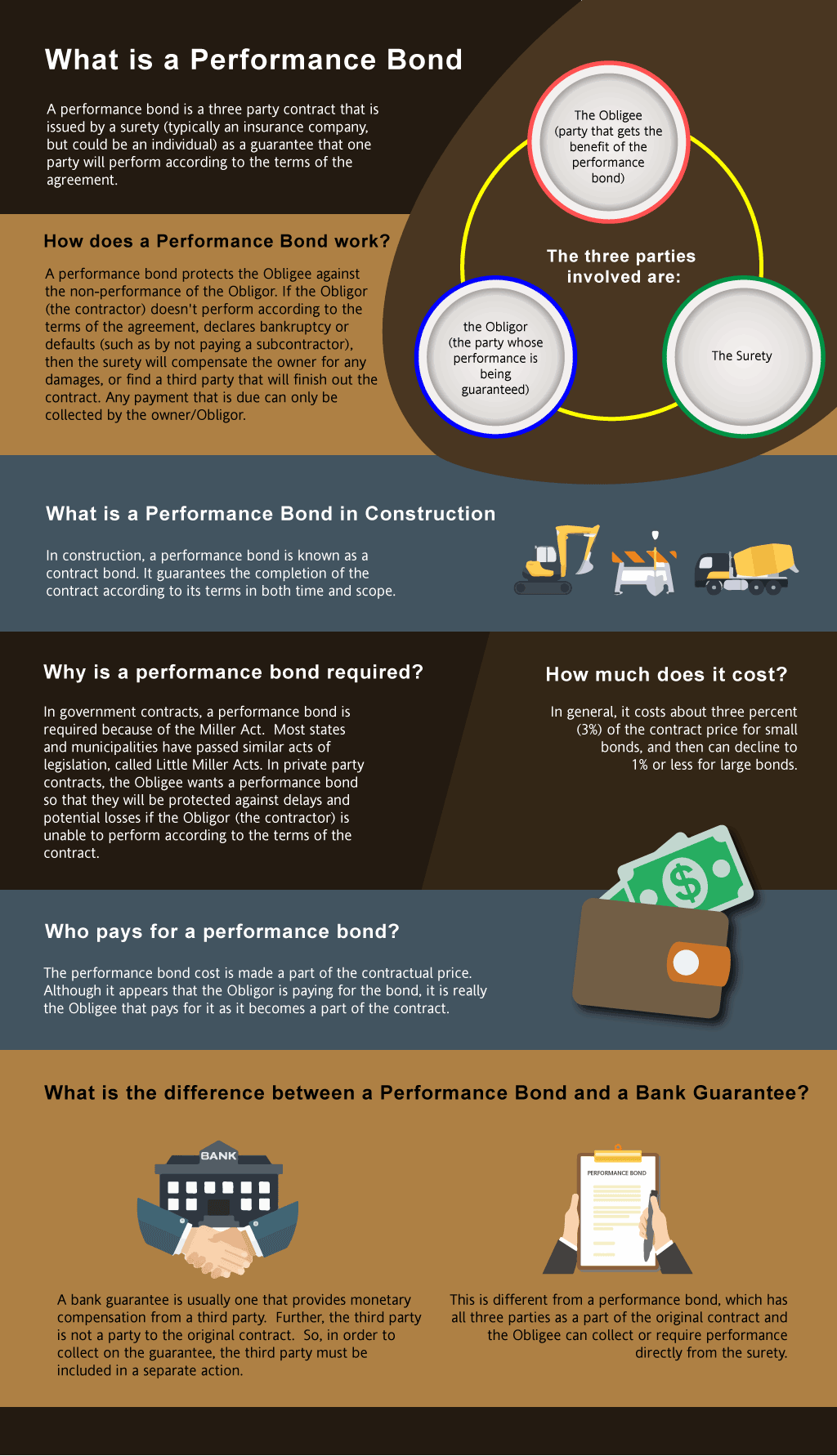

Performance bonds are guarantees provided by a third-party surety company that a contractor will fulfill their contractual obligations. These bonds protect project owners against financial loss if the contractor fails to complete the project according to the terms specified in the contract. Essentially, they serve as a form of insurance for both parties involved.

The Role of Surety Companies

Surety companies are essential in the performance bond process. They assess the risk associated with providing a bond to a contractor and require collateral or premium payments in exchange for backing the contractor's performance. This relationship is integral to ensuring that contractors meet their obligations.

Types of Performance Bonds

There are several types of performance bonds, including:

Is Your Money Safe? The Refundability of Performance Bonds

When considering whether your money is safe with performance bonds, it's crucial to delve into their refundability aspect.

Are Performance Bonds Refundable?

This question often arises among those engaging with performance bonds: Is performance bond refundable? Generally speaking, performance bonds themselves are not refundable; however, there are nuances worth discussing.

Understanding Non-Refundable Premiums

Typically, when you pay for a performance bond, you're paying a premium based on a percentage of the total project cost. This fee compensates the surety company for assuming risk and is generally non-refundable once paid.

Contractual Considerations

In some cases, contracts may stipulate conditions under which parts of fees could be refunded. It’s essential to read these agreements closely to understand any potential for recovery.

When You Might Get Your Money Back

Although most performance bond payments are non-refundable, there are scenarios where you might recoup some costs:

- If the project is canceled before initiation. If there’s an overpayment due to miscalculation. Certain agreements may outline specific conditions under which refunds apply.

The Importance of Documentation

Proper documentation can play a pivotal role in securing refunds or credits associated with performance bonds. Keep all records organized and accessible should disputes arise over charges or refunds.

Factors Influencing Refundability Decisions

Project Type and Scale

The scale and nature of your project significantly influence whether you might see any refunds related to your performance bond premium. Larger projects often have more complex agreements that may offer some flexibility regarding refunds.

State Regulations and Laws

Each state has its regulations governing performance bonds and associated fees. Familiarizing yourself with local laws can provide better insights into your rights regarding refunds.

Surety Company Policies

Different surety companies operate under varying policies regarding refundability. Always inquire about these details upfront before entering into an agreement.

Common Myths About Performance Bond Refundability

Myth 1: All Performance Bond Fees Are Refundable

This is far from true; as mentioned earlier, most fees paid for securing performance bonds are non-refundable unless otherwise stated in contracts.

Myth 2: A Contractors' Default Guarantees Complete Loss of Funds

While defaulting contractors can lead to complications and potential losses, it doesn’t necessarily mean all funds paid towards securing a bond are Home page lost forever—especially if proper documentation exists!

Navigating Complexity: How To Safeguard Your Investment?

Conducting Due Diligence on Contractors

Before entering into any contract that requires a performance bond, ensure you conduct thorough research on the contractor's reputation and past projects.

1. Review Past Projects

- Look at previous work completed by the contractor. Assess feedback from previous clients regarding reliability.

2. Verify Licenses & Insurance

- Confirm that they hold valid licenses and appropriate insurance coverage.

3. Seek Recommendations

- Get feedback from industry peers who may have worked with them before.

Understanding Contract Terms Thoroughly

Before signing on any dotted lines, take the time needed to comprehend every facet of the contract—especially those relating to your financial commitments regarding performance bonds!

FAQs about Performance Bond Refundability

FAQ 1: What happens if my contractor defaults?

If your contractor defaults on their obligations, you can file a claim against the performance bond with the surety company responsible for issuing it.

FAQ 2: Can I negotiate terms regarding my bond?

Yes! Many aspects of contracts—including payment terms—can often be negotiated before finalization so long as both parties agree upon them beforehand!

FAQ 3: Is there an alternative way to secure my investment other than using a performance bond?

Absolutely! Alternatives include letters of credit or cash deposits—though each comes with its risks/benefits too!

FAQ 4: How do I know if I’m getting scammed?

Research should help identify reputable companies; look out for negative online reviews or lack thereof! Also trust your instincts; if something feels off…it probably is!

FAQ 5: Why do I need a surety company involved?

A surety company acts like an insurance policy protecting interests on behalf both parties involved while also ensuring accountability throughout various processes involved during completion stages!

Conclusion

In conclusion, understanding whether your money is safe through performance bonds involves recognizing how refundability works within this financial instrument's framework. While most fees remain non-refundable once paid—a few exceptions exist based upon specific circumstances outlined clearly within contractual agreements made prior signing anything! Always conduct thorough due diligence while interpreting legal jargon carefully—it will save headaches down road later!

Ultimately remember… Is your money safe? With knowledge comes power; arming oneself ahead time ensures protection indeed remains solidified!