Introduction

Entering the world of contracting can feel like stepping into a labyrinth. The path is filled with opportunities, but there are also challenges that may leave newcomers feeling overwhelmed. One of the most significant hurdles for new contractors is obtaining a surety bond. Understanding what surety bonds are and how they function is crucial for your success. This article will provide detailed insights and practical tips to help you navigate this essential component of the contracting business.

What Are Surety Bonds for Contractors?

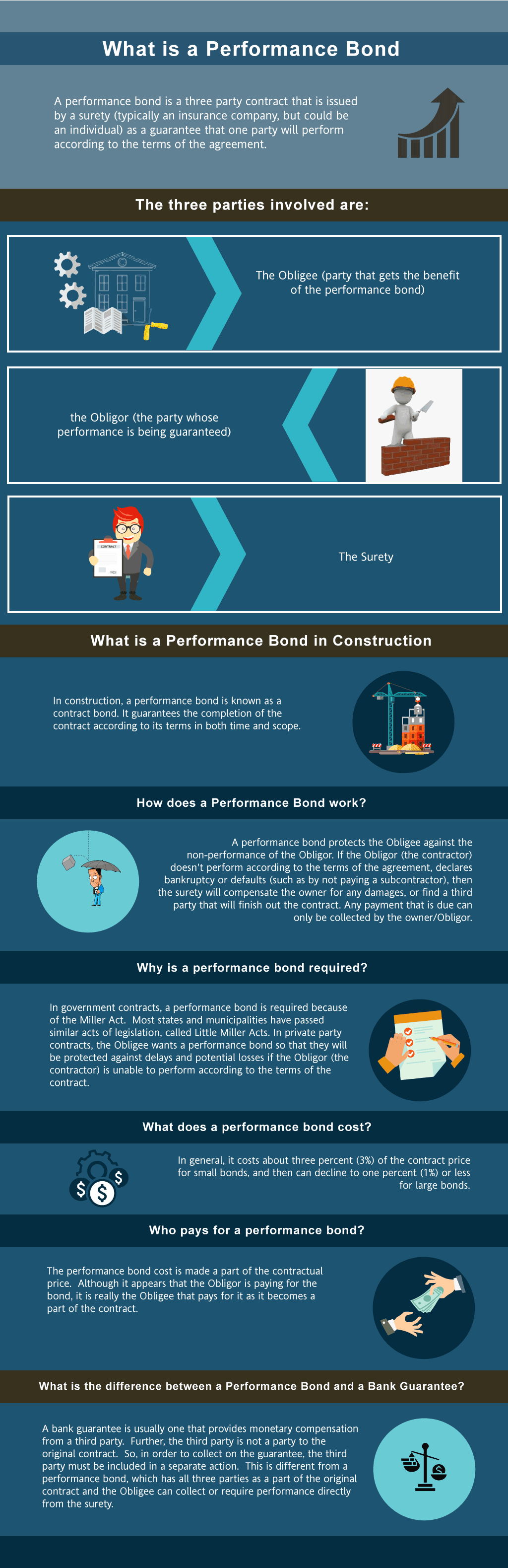

Surety bonds are agreements that guarantee the fulfillment of a contract or obligation between three parties: the obligee (the entity requiring the bond), the principal (the contractor seeking the bond), and the surety (the company issuing the bond). In essence, when a contractor acquires a surety bond, they are ensuring that they will complete their contractual duties according to specified terms.

Types of Surety Bonds for Contractors

Contract Bonds: These ensure that contractors fulfill their contractual obligations.- Performance Bonds: Guarantee project completion. Payment Bonds: Ensure subcontractors and suppliers are paid.

License and Permit Bonds: Required by local governments to ensure compliance with laws.

Miscellaneous Bonds: Used for various purposes including court bonds, fidelity bonds, etc.

Understanding these types can help you determine which bonds you may need as a contractor.

Why Are Surety Bonds Important for Contractors?

Obtaining a surety bond serves multiple important functions:

- Credibility: A surety bond signals to clients that you’re trustworthy. Legal Requirement: Many projects require bonding by law. Financial Protection: They protect project owners from financial loss due to contractor failure.

Tips for New Contractors Seeking Their First Surety Bond

When it comes down to securing your first surety bond, knowledge is power. Here are some key tips every new contractor should consider:

Understand Your Needs

Before applying for a bond, assess your specific needs based on your project type and size. This understanding will guide you toward selecting the right type of surety bond.

Build Your Financial Profile

Sureties evaluate your creditworthiness before issuing a bond. Therefore:

- Maintain good credit scores. Keep financial statements organized.

Gather Necessary Documentation

To facilitate a smooth bonding process, prepare necessary documents:

- Business license Financial statements Project details

Consult with Experts

Don’t hesitate to seek guidance from professionals in the industry. Experienced agents can provide invaluable advice tailored to your situation.

The Application Process for Surety Bonds

Applying for surety bonds might seem daunting at first glance, but breaking it down into manageable steps can simplify the process significantly:

Step 1: Gather Required Information

You’ll need:

- Personal identification Business information Financial documents

Step 2: Choose a Reputable Surety Company

Research reputable sureties; look for those specializing in contractor bonds.

Step 3: Complete Your Application

Fill out an application form accurately and comprehensively.

Step 4: Undergo Credit Evaluation

The surety will conduct credit checks and review your financial stability.

Common Challenges Contractors Face When Obtaining Surety Bonds

While many contractors successfully obtain their first sureties without major issues, several common challenges may arise:

Poor Credit History: A less-than-stellar credit history can hinder approval chances. Inadequate Experience: Lack of experience may lead underwriters to question reliability. Insufficient Documentation: Missing paperwork can delay or deny bonding applications.How to Overcome These Challenges?

Knowledge helps overcome barriers effectively:

Improve credit scores through timely payments and managing debts. Build experience via smaller projects before tackling larger ones. Double-check documentation against requirements listed by the sureties.Understanding Costs Associated with Surety Bonds

When budgeting for a project, it’s crucial to factor in costs related to surety bonds:

Premiums

The premium is generally calculated as a percentage of the total contract value, typically ranging from 0.5% to 3%.

Additional Fees

Some companies may charge additional fees such as:

- Administrative fees Renewal fees

Here's an example table showcasing potential costs based on contract values:

| Contract Value | Estimated Bond Premium | Total Cost Including Fees | |------------------|-----------------------|---------------------------| | $100,000 | $500 - $3,000 | $600 - $3,200 | | $500,000 | $2,500 - $15,000 | $2,600 - $15,300 | | $1 Million | $5,000 - $30,000 | $5,100 - $30,300 |

Factors That Affect Surety Bond Premiums

Several factors influence how much you'll pay for your surety bond premium:

Credit Score: Higher scores typically equate to lower premiums. Business Experience: More experience in contracting often results in reduced costs. performance bond examples Type of Work: Riskier projects usually lead to higher premiums due to increased liability. performance bondsThe Importance of Choosing the Right Surety Company

Not all sureties are created equal; selecting one aligned with your needs is essential:

1. Researching Potential Companies

Investigate their reputation within the industry and read customer reviews online.

2. Assessing Specialization

Look for companies specializing in contractor bonds; they’ll better understand unique requirements.

FAQ Section

Here are some frequently asked questions concerning surety bonds contractors might have:

1. What Is A Surety Bond?

A surety bond is an agreement involving three parties that guarantees one party will fulfill its obligations under a contract or law.

2. How Do I Know If I Need A Surety Bond?

Most likely if you're bidding on public contracts or required by law; check with local regulations or clients requesting bids.

3. Can I Get A Surety Bond With Bad Credit?

Yes! While challenging, it's possible through specialized agencies willing to work with individuals facing difficulties due to poor credit history.

4. How Long Does It Take To Get A Surety Bond?

Typically anywhere from a few days up to two weeks depending on complexity and required evaluations by bonding companies.

5. What Happens If I Default On My Bond?

If you fail on obligations outlined in your contract leading up defaults on your bonding agreement; resulting compensation would be sought from you directly by involved parties after covering claims made against them by affected individuals/entities!

6.How Can I Lower My Surety Bond Premiums?

Improving personal/business credit score along with gaining more industry experience over time tends toward better rates available when seeking future insurance products like these!

Conclusion

Securing your first surety bond as a new contractor is undeniably pivotal in establishing credibility while enhancing opportunities within this competitive field! Previous discussions highlighted essential strategies aimed at navigating complexities surrounding this topic efficiently; whether it was understanding implications behind different types available today or recognizing factors affecting premiums—knowledge empowers success!

As you embark upon this journey armed with newfound insights gained here today remember always stay proactive & informed throughout entire process ahead—it'll undoubtedly yield fruitful results moving forward! For more information regarding Tips for New Contractors Seeking Their First Surety Bond we recommend reaching out directly specialized firms capable providing tailored assistance catering needs accordingly!